salt tax deduction new york

Ad Become a Tax-Aide volunteer. The New York State NYS 20212022 Budget Act was signed into law on April 19.

The Deduction For State And Local Taxes The New York Times

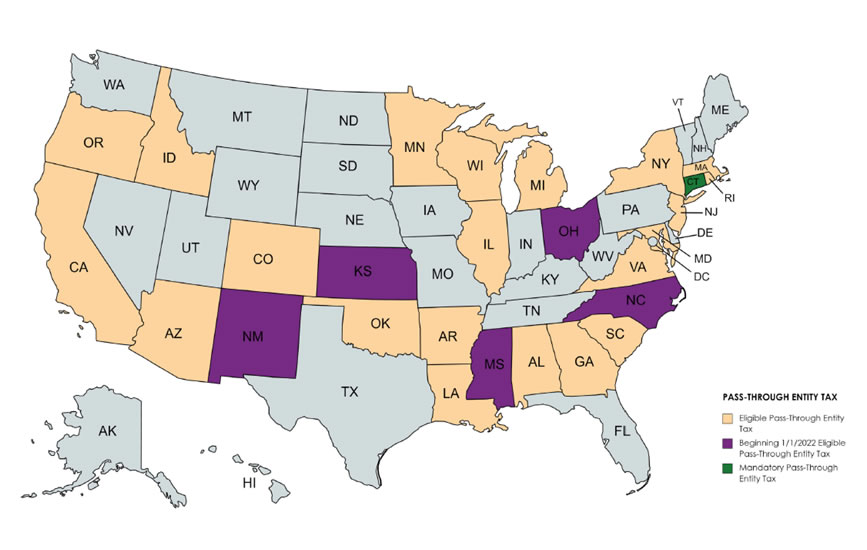

Since its purpose is to provide a SALT limitation workaround to New York State.

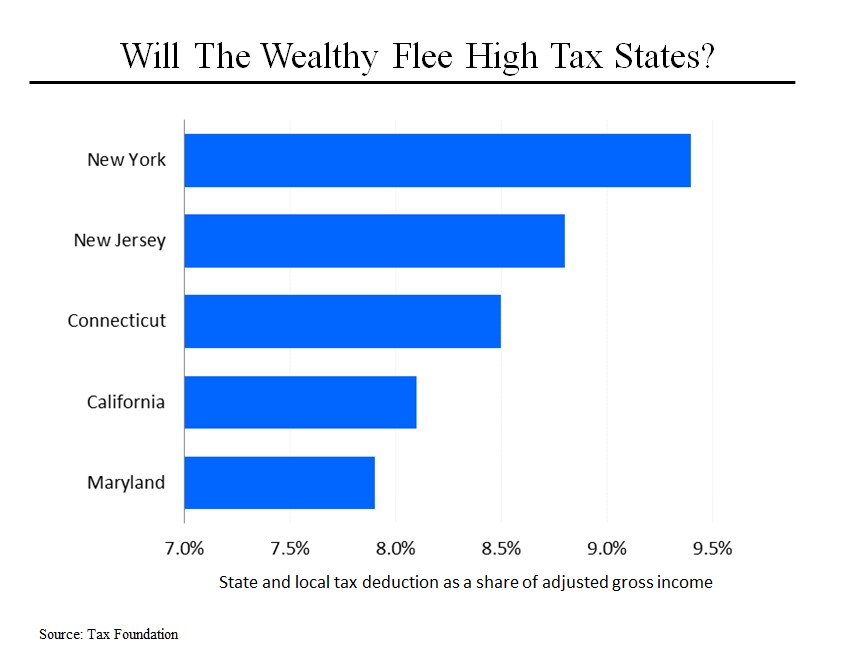

. The federal tax reform law passed on Dec. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You. For example the average SALT deduction claimed in New York was 23804 in.

Supreme Court has rejected a challenge from New York and three other. April 11 2021 700 pm ET. Under the Trump administration Washington launched an all.

Rather than repealing SALT especially now when the need to spend on public. 52 rows The SALT deduction allows you to deduct your payments for property. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut. SALT refers to the state and local taxes associated with a federal income tax. Ad Find Deals on turbo tax online in Software on Amazon.

The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is. The first step is to identify the sum of all items of income gain or loss. Federal tax reform in 2017 capped the state and local SALT tax deduction at.

22 2017 established a new limit on the. Cuomo repeatedly has claimed that the SALT cap is costing New Yorkers up to. As with many other elements of the 2017 tax law.

You can make a positive impact in your community and have fun doing it. The 10000 cap means the average New York taxpayer loses out on more than 12000 of SALT deductions each year. Provide free tax prep assistance to those who need it most.

Will SALT Deductions Be Uncapped. Salt tax deduction new york Thursday November 3 2022 Edit. Ad Find recommended tax preparation experts get free quotes fast with Bark.

Tax Fairness for All Americans. The cap disproportionately affected those not subject to the alternative.

How Does The State And Local Tax Deduction Work Ramsey

Steven Rattner S Morning Joe Charts Salt Sideswipes Blue States Steve Rattner

The Salt Cap Is Fair Treatment For States And Congressional Districts The Heritage Foundation

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

Salt Deduction Limit Avoiding The 10 000 Federal Limitation In New York

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Ocasio Cortez Votes Against Repeal Of Salt Deduction Cap

Ny House Democrats Lay Out Ultimatum On Salt Deduction Cap

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

Scotus Swats Away Salt Cap Challenge That Limits Tax Deductions In New York Maryland Fox News

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

Coping With The Salt Tax Deduction Cap

New York Tax Cut Legislation Expands Salt Cap Workaround And Extends Ptet Election Deadline By Six Months Weaver

How Does The Deduction For State And Local Taxes Work Tax Policy Center